Global investors are becoming less confident in their climate investing strategy and the net-zero transition achievability, asset manager Robeco finds in its 2025 global climate investing survey, which reflects the increasing complexities of sustainable finance activities in today’s macroeconomic and political uncertainty.

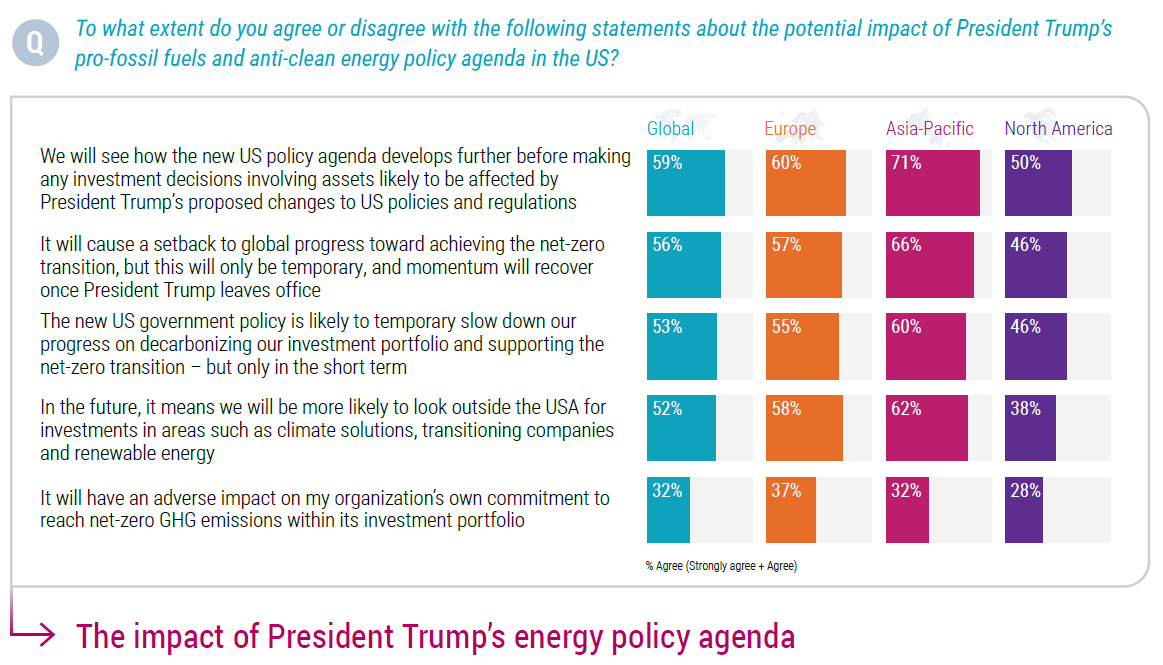

Based on feedback from 300 institutional and wholesale investors in Europe, North America, Asia-Pacific, and South Africa, the results of the survey highlight strong headwinds against climate investing from the political shift in the United States: 59% of investors say their investment decisions will be affected by new policies and regulations under the Trump administration, and 56% believe Trump’s energy policies will cause a temporary setback to global progress in achieving the net-zero transition.

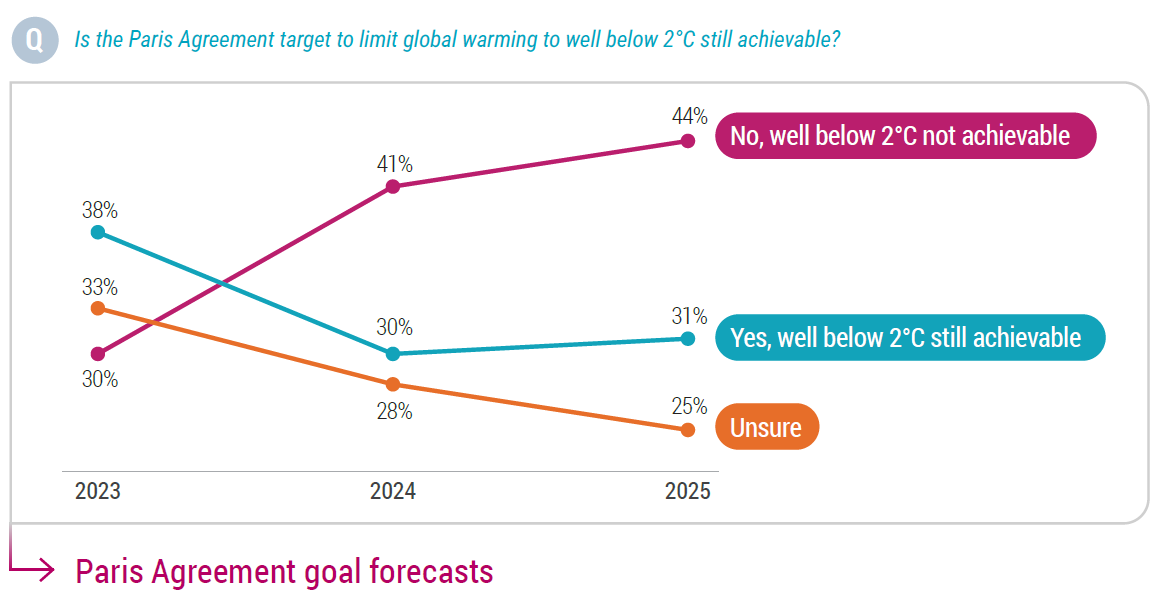

Meanwhile, investors’ confidence in global efforts to contain climate change is also waning: 44% of respondents believe the Paris agreement’s target of limiting global warming to well below 2oC is not achievable, up from 41% a year before.

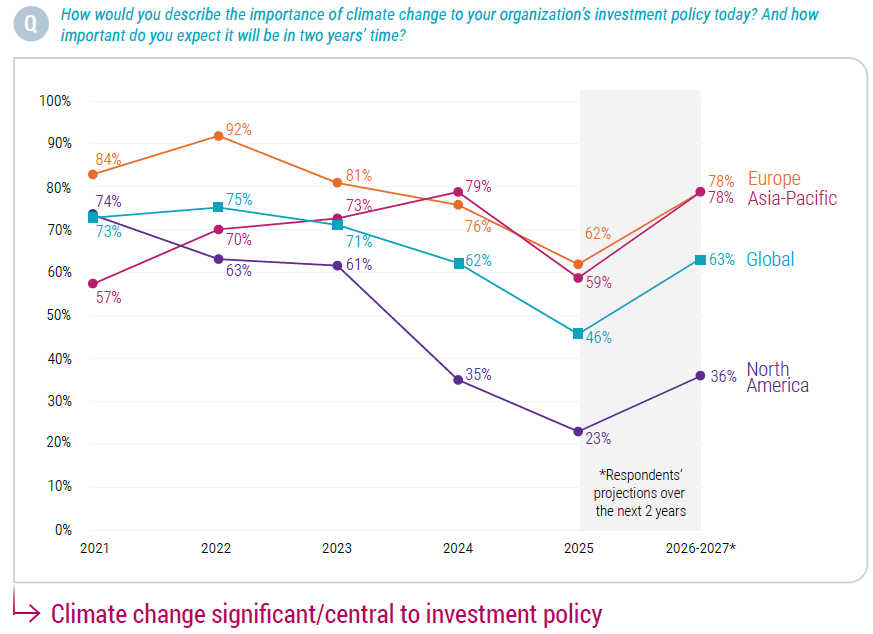

The pessimistic outlook has driven investors to adjust their climate investing strategy. The proportion of investors putting climate change at the centre of their investment policy, or considering it as a significant factor in their policy, has dropped to 46% this year, from 62% in 2024.

Also, only 57% of the investors plan to invest more in climate solutions, either as a general aim or via a quantitative target, dropping from 69% in the previous year. Interestingly, respondents find climate adaptation as an investment solution, and more attractive than climate mitigation solutions and technologies.

“One of the most notable findings from this year’s Global Climate Investing Survey is the disillusionment of investors with the lack of supportive policies enabling investments in the net-zero transition. Investors have massively committed to net zero by 2050 but generally feel that governments did not live up to their part of the commitment,” says Lucian Peppelenbos, climate and biodiversity strategist at Robeco.

However, the survey finds that the proportion of Asia-Pacific investors who hold climate change as a significant factor in investment policies ( 59% ) is still above the 2021 level ( 51% ), despite a slide from 79% in 2024.

Moreover, respondents from all regions expect the importance of climate change to their organization’s investment policy to rebound from the current level in two years, suggesting that while the current environment adds difficulties to their investment decision-making, their long-term commitment to climate investing remains intact.

“The science did not change – net zero is still a physical necessity – but currently investors are rebalancing and revising their climate strategies,” Peppelenbos stresses. “To unleash next steps, it is vital that commitment and conviction among investors are paired and reinforced by more segments in society.”